Have you been hearing about environmental, social and governance pillars (ESG) lately? Recently it came up for me (via the news), because Tennessee (my state) is suing BlackRock (the asset management group with major, major investments in Apple, Microsoft, Amazon and Google, as well as Nvidia and Broadcom) claiming they misled Tennesseans on their investment strategies.

So why is everyone so upset? What is ESG, and why is the strategy so important? “Basically, why do I care?”

Corporations that take investors money are going to have to care. More and more, investors around the world are asking for context to the financial sheets currently provided.

It’s not enough to just make money and show a return any longer. Investors are asking: what is the short and long term game for this company? Are they ethical? What is the carbon footprint? How do they treat their employees? How do they hold people accountable for their tasks?

ESG is just 3 factors that help measure a companies sustainability, ethics and the social impact it has on the world. In simple terms: it’s additional metrics that can be used to weigh the risk a company has in the short and long term when investors look at a company, or even a industry, as a whole.

ESG: Enterprise Maturity Level

An organization may be at any stage of the ESG process for investors to require the tracking and submission of reporting. That means if your data is siloed, it could take weeks — even months — to ensure it’s accurate for an investor to see. Some investors won’t wait that long, other times it might be for an audit and your company may be fined for taking too long to send the required reports.

The ESG maturity model is not universally defined, however it can be defined as follows:

- Ad-hoc (spreadsheets and documents): no formal process or tool in use; siloed activities for data, lack of transparency internally and externally; no real strategy or details around the strategy

- Disclosure-driven (semi-automated processes): metrics and reporting are in place and often driven by investors or regulatory needs; annual reporting; likely a tool in place but it may not be enterprise wide

- Governed: formal tracking of initiatives, governance processes, compliance and policies; C-suite actively engaged and own tasks related to the tracking; likely Enterprise wide

- Integrated (across Enterprise and Value Chain): decisions are connected across the enterprise, measures are aligned to executive compensation, integrated reporting requirements

Adopting ESG

For the companies that do adopt an ESG strategy, or are looking for guidance on how to start that program, ServiceNow can help.

ServiceNow offers a free comprehensive guide book to help you align your business goals with ESG commitments.

Examples of commitments:

- Responsible procurement

- Diversity, inclusion, and belonging at work

- E-waste reduction

Specific Ideas:

- Hybrid/remote work options

- Swap straws in the break room or other products such as light bulbs, automate lights “time on and time off”

- Lower your office temperature 1 degree

- Look at procurement providers and add a new metric for ESG and how they embrace it or pick a specific point such as their field trucks are all hybrids, they partner with fair trade groups, etc

- Talk to the delivery company to see if you can reduce/combine deliveries (so they don’t drop as much)

- Honor diverse holidays (ex: newer holidays such as Juneteenth, or other countries holidays for employees if the company is not able to close)

- Routine company volunteering opportunities

How does ServiceNow help?

ServiceNow offers a flexible, easy to grow in the enterprise, application that will track and report on all of your initiatives related to ESG.

- Easy to define key metrics

- Automate data and reporting

- Assign owners

- Map metrics to disclosure citations such a Global Reporting Initiative (GRI) and Task-Force for Climate-Related Financial Disclosures (TCFD)

- Automatically generate disclosures about the data

In my opinion there is 1 part of ESG that stands out specifically. Of course the application offers an executive dashboard, manual and automated data collection, status checks on goals and targets and automated disclosures.

Automated disclosures are very specific type of public reporting about a department, initiative or event that is reviewed/audited for ESG (and audits). They include: goal based, framework-based and ad-hoc disclosures.

If your organization does not have a set of measures for ESG, or is looking where to start, then the ‘Framework Disclosures’ may be for you. The frameworks consist of standard information related to the global standards organizations such as GRI, TCFD and SASB – this includes:

- Name, type, and the time periods that you want to display the data for in the disclosure. The types of disclosures that belong to this category of disclosures are the Regulatory and Framework disclosures.

- ESG framework that the disclosure is based on. For example, the Global Reporting Initiative (GRI) SASB framework.

- Citations to be included in the disclosure.

So right out of the box, you can pull in this data and get started.

Note: I want to highlight/stress that this is not automatic — there is NO ‘wizard’ for this application. There is a project for implementation / configuration that is both process and technical, that must be planned and completed for this application to be useful.

ESG + SASB: Right out-of-the-box

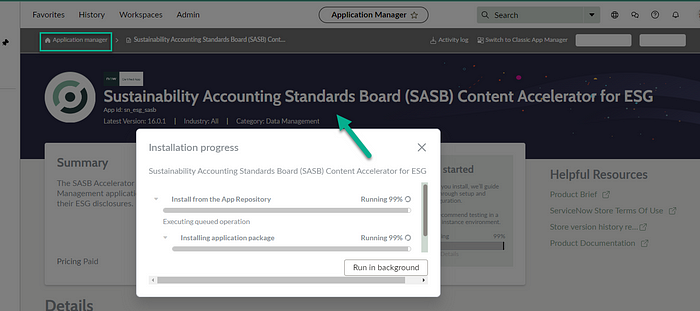

Let’s take a real look at the SASB Content Accelerator for ESG….. that you download from the application manager (you need the sn_esg.program_manager role).

Feel free to check this out on your PDI if you are an existing ServiceNow customer. If you are not, reach out to a sales rep and ask for a demo.

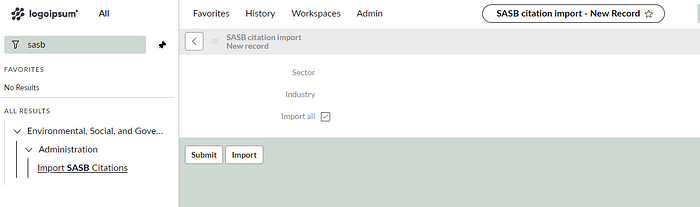

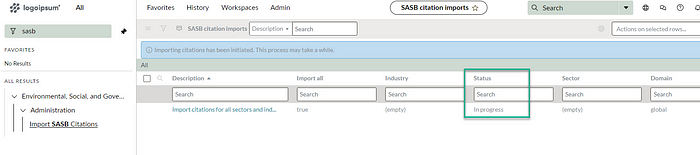

You can import and then choose the SASB citations to track:

When complete, go to the ESG workspace and choose the “pancake stack” on the left and you will see the SASB option — choose update

Notice the other frameworks are available. It’s the same process for using those, just select the correct year from the dropdown and press ‘activate’ or ‘update’.

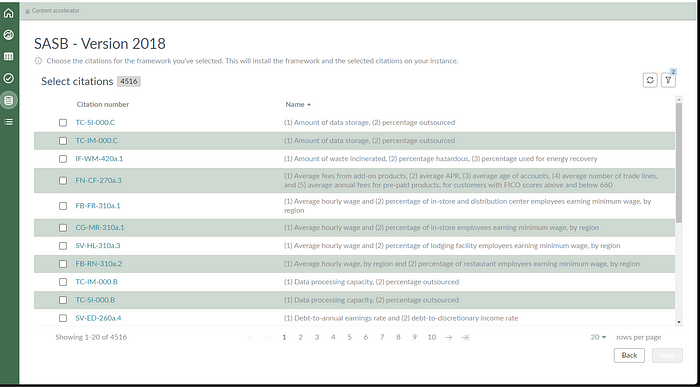

Choose the citations:

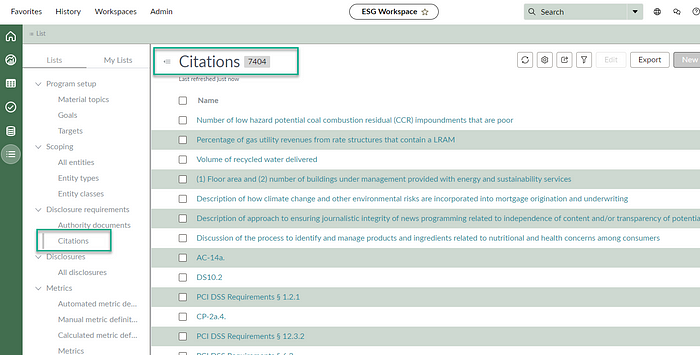

Then go to the ‘list view’ (the lines with the dots on the left of the ESG workspace under ‘Lists’ tab) and locate ‘Disclosure Requirements > Citations’

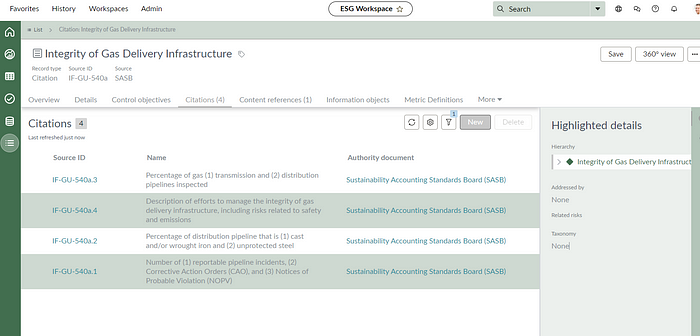

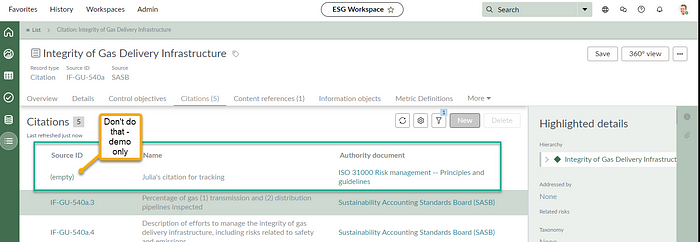

You can then open one and check out the associated citations for tracking and reporting on:

NOTE: there is more work to do, specifically now that it’s imported you associate the citations with the metrics and metric definitions — but my point is to demonstrate the options that are out of the box.

On the top right you are able to add your own ‘new’ citations if needed for tracking.

Overall, for companies looking into ESG — ServiceNow makes it fairly easy to track a very complicated subject, that has very high impact if it’s not done correctly. As demonstrated on the PDI above in the screenshots. However, if you choose to keep it out of the box — emphasize/require a training program for business process in the request for purchase.

Automating the disclosures, allowing easy imports of global standards for reporting and a unified, dedicated, workspace that not only displays the metrics an ESG manager would need but the tasks and approvals that are needing attention — this application is a solid way to start your company down the #ESG path.

Learn More:

Global Standards:

- Sustainable Accounting Standards Board — SASB

- Global Reporting Initiative — GRI

- Task-Force on Climate-Related Financial Disclosures (TCFD)

Discover more from Julia's Dev

Subscribe to get the latest posts sent to your email.